“September stands alone as the only month in which the market falls more frequently than it rises.” — Sam Stovall, Investment Strategist

Typical Seasonal Returns

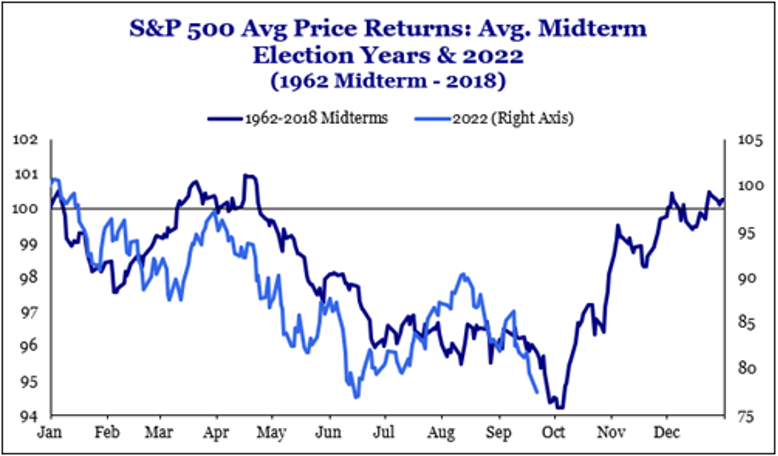

I guess you could say that, in one sense, September delivered. It has the well-deserved reputation of being the worst single month in the market, historically, with an average post-World War II return of -0.56%.1 The only other month that has generated an average negative return over this same time span is February. This September preserves its historical negative streak, as the S&P 500 fell almost 9% during the month.2 The good news is that, on average, November and December are some of the best months for stock returns, and there has never been a negative 12-month period for stocks following a midterm election since 1942. I’m sure I have jinxed this by making such a comment and by presenting the chart below:

Source: Strategas

2022 Market Pullback Continues

So, there seems to be some normal seasonality to this return pattern, but the year-to-date 2022 decline is also obviously associated with the current wall of worry items that run the “page-one” gamut from inflation and Federal Reserve policy risks to geopolitics and war. Therefore, the 2022 pullback continues. Corrections are generally larger than normal in midterm election years, but 2022’s is even larger, probably due to these other concerns I cite above.

Specifically, the S&P 500 closed at 3,585 on September 30.3 As the leaves begin to turn in October, this Index stands just below the prior low of 3,666 recorded on June 16 and is down 24% from its January 3 high. Looking back at things, as the market rallied handsomely to the 4,300 level through mid-August from that June 16 low, I’m sure that we were all hoping that perhaps the market had bottomed in June and that a definitive bull market had begun anew.4 However, as we all also know, hope is not a plan.

While the market indeed showed typical signs that tend to occur around prior troughs (e.g., leadership had shifted from the defensive sectors earlier in the year when the market was swooning to the more risk-on areas such as technology and consumer discretionary during the brief summer rally), the optimism didn’t last. While we were not forecasting it, we were not completely surprised by this retest of the prior low—this is quite normal activity during corrective/transitional periods in the stock market.

Continue to Hold Your Ground

Rallies are frequently followed by retests before the selling is exhausted and the stage is set to move on to a more sustained recovery and to a path of new highs that we expect in 2023. These moments of churn are not tradable because short-term activity at these moments is so unpredictable, but the fact that we have retested prior lows is not unusual. Recognition of this tendency, coupled with our comprehensive assessment of the evolving fundamental, valuation and technical data, is what has led us to maintain our message of “hold your ground” rather than “buy the dip.” This has been our consistent mantra in 2022. We suggested in January that if the outsized returns over the last three years had taken one’s stock allocation to above normal levels, cut back to normal and stay there. Don’t sell from that point but don’t add on further potential sell-offs just yet, either. Be selective in what you own, with high-quality securities being preeminent. We’re glad we didn’t take the head fake to aggressively add stock exposure as the market was rallying in that mid-June to mid-August time frame.

That said, we do remain positive about the prospects for stock market gains over the next 12-15 months and do believe there will be a time in the reasonable future to add stock exposure. In the interim, let’s review our take on the weakness in the market (both on a year-to-date basis and more recently), as well as where we think we go from here and how to best manage through it.

What’s Changed Recently?

There have been several key pieces of news in the last several weeks that have caused sentiment to roll over and turn negative once again after having improved midsummer. While psychology is poor right now, the fundamentals and valuation aren’t. The economy is slowing down, but even if it should slip into a recession, the decline would be expected to be mild in nature.

Employment data continues to be robust as:

- Significant jobs are being created each month.

- There are far more job openings than there are unemployed workers to fill them.

- Unemployment claims are at still-tepid levels.

- The overall unemployment rate stands at close to all-time lows at 3.7%.

Compare this to deep recessions in 2007-2008 and in the 1920s and 1930s when unemployment ranged at a much higher rate of 10%-20%.5 Consumer spending may be shifting from goods to services as the economy continues to reopen, and we’re increasingly going back to work, but it is still healthy, albeit different, in mix versus the cocooning days of the pandemic.

In fact, the most recent data shows personal consumption growing at an annual clip of more than 8%,6 and the consumer represents roughly 70% of our economy. Housing may be extremely soft, but that is not stopping consumers from spending on other items and services. Contrary to the chorus of negative headlines regarding all inflation metrics, inflation is calming in many areas, ranging from commodities (energy related, with the exception of natural gas, metals and agricultural) to appliances, furniture, used cars and lodging. Event rents, which are calculated in a very confusing manner (that confuses even expert investors), show signs of peaking.

Some Recent Surprises

So, if the economy still is exhibiting modest growth in key areas, people are still employed and spending, and inflation is starting to move in a better direction, what’s making everyone so crabby? There were two news items that seemed to bring things to a head in the last couple of weeks.

First FedEx, the package delivery company, preannounced earnings and guided numbers down significantly for the rest of the year. This caused investors to fear that the rest of corporate America would be guiding down in “here comes a deep recession” fashion. We do not think this is the case. Yes, earnings numbers will probably be revised down for the S&P 500 for 2023 as the economy slows, but we do not believe to the tune of the FedEx report. There are company-specific issues for FedEx given its significant business in Europe and Asia that do not apply to a number of U.S.-based companies with less exposure in those areas. In addition, FedEx has lost the Amazon-related business, which is not insignificant in its impact.

Second, the Fed is sounding much more hawkish about interest rates having announced another .75% increase in the fed funds rate, taking it to 3.25% in its September meeting.7 While we expected it to affirm that it wants to remain vigilant in its focus to bring inflation down, we were surprised about the severity of its hawkish tone. In addition to the .75% bump in rate in September, Fed Chairman Jerome Powell announced intentions of the Fed board to increase the 2023 target up to a peak level of 4.5% versus the prior 3.5% guide.

Further, Powell mentioned a number of times in his press conference following the committee’s mid-September meeting that policy was focused on fighting inflation even if it caused “pain” in the form of rising unemployment and a slowing in the economy. This tough talk spooked investors. While investors ran for cover on this news and yields spiked, we believe this is an overreaction. It appears to us in examining the Fed’s Summary of Economic Projections published after each meeting that it is talking much tougher than the numbers and its true forecast reveal.

The actual data is much less concerning than the manner in which it has been delivered at Powell’s press conferences. In the end, Powell also said that the Federal Reserve Board expects the economy to grow slightly this year and by 1% next year. That doesn’t sound like deep recession. He stated that he is pleased that consumers’ longer-term inflation expectations remain “well anchored.” He also said he expects peak unemployment to reach only 4.4%, which is hardly oppressive in nature. The Fed chair seems to be posturing more than describing reality grounded in the data. The fed funds future curve seems to agree with this interpretation, as it indeed forecasts the fed funds rate to rise to the 4.5% level in 2023 but to stabilize at that point and then fall below 4% in early 2024.8

Inflation Number to Closely Watch: CPI versus PCE

For those scratching their heads about how the Fed thinks it can reduce the headline inflation number as reflected in the year-over-year rate of change of the Consumer Price Index (CPI) at 8.3% to below 3% in short order, this is not what the Fed intends to do or how it will measure its success in getting inflation under control. The Fed’s key barometer for inflation is something called the core personal consumption expenditures deflator or the year-over-year rate of change of the Core Personal Consumption Expenditures Price Index (PCE)…not the CPI that we all read about. This PCE deflator figure stands at a much lower 4.9%.9 The Fed’s goal to get this figure below 3% appears much more achievable in a reasonable time frame than the headlines make people believe and without pursuing a “scorched-earth” policy of driving rates higher than feared. The major difference between the two barometers of inflation is that rents and housing costs represent over 30% of the CPI, while they constitute only 15% of the PCE; the core price indexes also omit energy and food categories. The Fed believes the latter is more representative of consumers’ true spending baskets. Stay tuned on this front.

Wrap-Up

While there are definitely worthy risk items on the current wall of worry, the S&P 500 is off 24%, which is almost the average peak to trough decline in the market that has occurred historically during normal recessions. So, the market has already discounted a normal recession based on history. We may have some additional downside from here, as the market can overshoot to the downside and to the upside. However, we think we are closer to the bottom than the top.

Given that some stocks have corrected much more than the Index, this is a great time for active management, in our view. Further, while we are not yet ready to buy on the dip until we see some additional inflation data, we are assembling our list of targeted securities we find attractive when we believe it time to do so.

What will get us to that point of suggesting it is time to add stock exposure and that we are more confident that stocks have bottomed? The technical data needs to improve via leadership shifting from defensive stocks to those that are more risk-on oriented and momentum needs to improve from these oversold levels. More importantly, we need to see several more months of broader improvement in the inflation data and hence a sense that the Fed will begin to embrace a more neutral tone. Getting past the midterm elections should also help, if history is any guide. We’ll discuss politics a bit more next month in our November commentary. In the meantime, we’re staying focused on the trends in the key fundamental data and what that may portend for equity investors.

Sources:

1,2FactSet

3Atlanta Federal Reserve

4,5FactSet

6,7FactSet Data and Y charts

Disclosures:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. The index is unmanaged and cannot be directly into. Past performance does not guarantee future results. Investing involves risk and the potential to lose principal.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.